Complete Guide to 2025 Tax Brackets for Married Filing Jointly – Calculate Your Federal Tax Rate Now

What Are Tax Brackets and How Do They Work?

In the United States, income is taxed using a graduated income tax system. This means your earnings are divided into portions, with each portion taxed at a different federal income tax rate. Many people mistakenly believe that earning more money pushes their entire income into a higher bracket. In reality, only the income that falls within a specific bracket is taxed at that rate. For example, if you’re in the 22% tax bracket, only the portion of income within that range is taxed at 22%, not your entire income. This system helps calculate a more balanced effective tax rate, which is typically lower than your marginal tax rate. Understanding how US tax brackets work is crucial for financial planning, especially for those married filing jointly. In 2025, these brackets determine how much of your taxable income is taxed and at what rate. Knowing this structure helps you better estimate your taxes and even identify legal ways to reduce them using tools like an income tax calculator.

Table of Contents

Understanding Graduated Income Tax in the U.S.

A graduated income tax also called a progressive tax means that as your taxable income increases, it is taxed in increments, not as a whole at one rate. For example, in the 2025 tax brackets for married filing jointly, the first portion of income may be taxed at 10%, the next portion at 12%, and so on up to 37%. This system is designed to be fair and scalable, helping low- and middle-income earners keep more of their money. The marginal tax rate applies only to the last dollar you earn within a tax bracket, while the effective tax rate reflects the overall percentage of your income paid in federal taxes. Many taxpayers use an income tax calculator to get an accurate estimate of their federal liability. Understanding this system helps individuals determine “how do you figure out your tax rate” and “how much does federal tax take out” based on their total income. This also answers common questions like “how much is income tax in the U.S.” or “what percentage of a paycheck goes to taxes.”

What Is the Federal Income Tax Rate?

The federal income tax rate is the percentage of your income that you pay to the federal government based on US income tax brackets. For those married filing jointly, the 2025 tax brackets offer seven different income ranges, starting at 10% and increasing up to 37%. These income brackets are adjusted annually to account for inflation. It’s important to distinguish federal tax from state income tax, as each state may have its own rates and rules. The tax slabs in the USA help determine your taxable income and how much you’ll owe in taxes each year. To answer “how to calculate federal income tax,” you’ll need to assess your gross income, subtract deductions (like the standard deduction), and apply the correct rates to each bracket your income falls into. Tools such as an income tax calculator can simplify this process and show both your marginal and effective tax rates. Understanding how these rates work is key to financial literacy, whether you’re earning $15,000 or $150,000 annually.

2025 Tax Brackets for Married Filing Jointly (Official IRS Rates)

The 2025 Tax Brackets for Married Filing Jointly will determine how much federal income tax you owe based on your total taxable income. These brackets range from 10% to 37%, with higher income levels falling under progressively higher rates. For example, if you and your spouse file jointly and have a combined taxable income within the first bracket, you’ll pay just 10% of your income in federal taxes. As your income increases and enters higher brackets, each additional dollar earned within those ranges is taxed at the next highest rate. It’s crucial to understand these US tax brackets to estimate your federal income tax rate and optimize your tax planning. Using an income tax calculator can help you determine the effective tax rate you’ll pay and show how different income ranges affect your overall liabili.

2025 Taxable Income Brackets (Side-by-Side Table Format)

Understanding the specific 2025 tax brackets for married filing jointly is key to determining your taxable income and the corresponding tax rate. The IRS has defined seven tax brackets, ranging from 10% to 37%, with each bracket applying to different levels of income brackets. To calculate your taxes, subtract applicable deductions from your total income to find your taxable income, and then apply the appropriate tax rate to each portion of income. For example, income up to $22,000 might be taxed at 10%, while any income between $22,001 and $89,450 will be taxed at 12%. Using these tax slabs in the USA, you can better understand “how to calculate federal income tax” and avoid any surprises during tax season. The marginal tax rate only applies to income that falls within a specific bracket, which is why the effective tax rate is typically lower than your highest marginal tax rate.

What Counts as Taxable Income?

When calculating how much is federal income tax, it’s essential to understand what counts as taxable income. For married filing jointly filers in 2025, taxable income includes not just salaries, but also bonuses, freelance earnings, investments, and other sources of income. Deductions and credits play a significant role in reducing your taxable income, so it’s important to know what you qualify for. For instance, the standard deduction for married couples can lower your taxable income, thereby reducing the amount of tax you owe. Moreover, taxable income brackets vary based on deductions and credits like child tax credits or retirement savings. To accurately calculate federal tax, make sure to consider all sources of income and apply any eligible tax-saving strategies. Tools such as an income tax calculator can help you determine the most accurate federal income tax percentage for your situation.

How to Calculate Federal Income Tax in 2025

Calculating your federal income tax in 2025 as a married filing jointly couple involves applying the 2025 tax brackets for married filing jointly to your taxable income. To do this accurately, you’ll first need to determine your total income, including salaries, bonuses, freelance earnings, and investment income. After calculating your total income, subtract any eligible deductions (such as the standard deduction) to arrive at your taxable income. Once you have your taxable income, use the applicable tax slabs in the USA to determine how much you owe. You can either use an income tax calculator for convenience or calculate it manually using the marginal tax rate for each income range. It’s important to remember that the effective tax rate is generally lower than the marginal tax rate, as it accounts for the progressive nature of the tax system.

Step-by-Step Income Tax Calculator for Married Couples

For those seeking a quicker way to calculate their federal income tax rate, using an income tax calculator is a great option. Simply input your total income and deductions, and the tool will automatically apply the 2025 tax brackets for married filing jointly to provide an accurate estimate. However, you can also manually calculate your taxes by following a step-by-step process. Start by subtracting eligible deductions from your total income to determine your taxable income. Then, apply the marginal tax rate to each portion of your income within the US income tax brackets. The calculator will help you understand the graduated income tax system and how different portions of your income are taxed at different rates. This approach gives you a clear picture of your effective tax rate and ensures you know exactly how much federal tax you owe.

Effective Tax Rate vs. Marginal Tax Rate

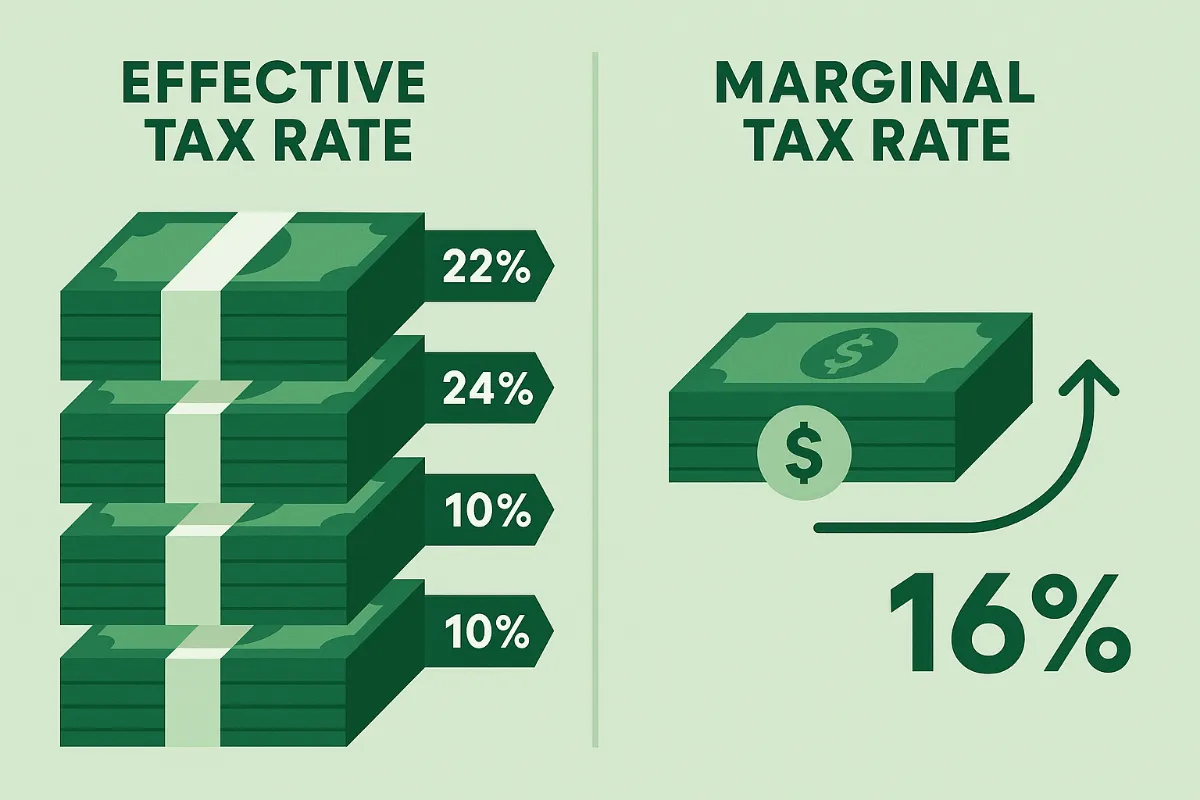

Understanding the difference between your effective tax rate and marginal tax rate is crucial for accurately assessing your federal income tax liability. The marginal tax rate refers to the tax rate that applies to your last dollar of income within the 2025 tax brackets for married filing jointly. On the other hand, the effective tax rate is the average rate you pay on all your income after applying all relevant deductions and credits. This rate is typically lower because only portions of your income are taxed at the higher tax slabs in the USA. For example, if your income falls into multiple tax brackets, each portion of your income is taxed at its respective rate, and the effective tax rate is the weighted average of these rates. Understanding both rates is essential for knowing how to calculate federal income tax and determining whether you’re paying a fair share or could benefit from additional deductions or credits.

How to Reduce Your Taxable Income in 2025

One of the most effective ways to reduce your federal income tax is by lowering your taxable income. For married filing jointly couples, the standard deduction in 2025 is a valuable option. By claiming this deduction, couples can subtract a flat amount from their total income, significantly lowering the taxable income. Alternatively, you may choose to itemize your deductions if they exceed the standard amount. Common itemized deductions include mortgage interest, medical expenses, and charitable contributions. These deductions are crucial in reducing the amount of income that will be taxed under the 2025 tax brackets for married filing jointly. By applying these deductions, you can effectively lower your taxable income, which could result in paying less federal income tax and help you stay in a lower tax bracket.

Tax Credits to Know in 2025: Save More on Your Taxes

In addition to deductions, tax credits are another way to reduce your tax liability. For married filing jointly couples, understanding credits like the Child Tax Credit and the Earned Income Tax Credit (EITC) can make a significant difference in your federal income tax rate. These credits are especially valuable because they reduce your tax bill dollar-for-dollar, unlike deductions that only reduce your taxable income. The Child Tax Credit offers a direct reduction in taxes for qualifying children, while the EITC helps low to moderate-income families. These credits are applied directly against your federal tax rate, ensuring that you pay less, regardless of your income tax bracket. Being aware of these tax-saving opportunities can help you plan effectively for tax season and potentially lower the amount of federal taxes you owe.

How Deductions and Credits Affect Your Tax Bracket in 2025

Deductions and credits play a vital role in determining your effective tax rate. After applying these savings, the taxable income may be lowered, pushing you into a more favorable tax bracket. For example, by utilizing deductions like mortgage interest or charitable contributions, your taxable income could fall below the threshold of a higher U.S. income tax bracket. Similarly, tax credits like the Child Tax Credit directly lower your federal tax rate, reducing the amount of taxes you owe without affecting your income bracket. Understanding how these deductions and credits work together with the 2025 tax brackets for married filing jointly will allow you to plan your finances better and minimize your federal tax liability. This knowledge is crucial for ensuring you pay the least amount possible, while still complying with the tax laws.

How the 2025 Brackets Differ from 2024

The 2025 Tax Brackets for Married Filing Jointly reflect important changes compared to the 2024 tax brackets. One of the key adjustments is the inflation adjustment, which leads to higher income thresholds, meaning you can earn more before moving into a higher income tax bracket. This adjustment helps keep up with rising costs of living, ensuring that inflation doesn’t push you into a higher federal income tax rate unfairly. For instance, the standard deduction for married couples filing jointly is also expected to increase. By understanding how these adjustments work, you can plan your finances better and avoid paying more than necessary in federal taxes. Long-term tax planning can help you strategize for these changes, enabling you to save money by reducing your taxable income and ensuring you’re in the most favorable tax brackets possible.

U.S. Tax Rates vs. Global Income Tax Rates

When it comes to tax rates, the U.S. operates with a graduated income tax system, which is different from some other countries. Compared to global income tax rates, the federal tax rate in the U.S. may seem high for higher earners, but the 2025 tax brackets for married filing jointly show that the progressive nature of the U.S. tax code means you only pay higher rates on income that falls into the higher tax slabs. Countries with flat tax systems may have a lower federal income tax percentage, but they don’t offer the same range of deductions and credits. U.S. tax rates are generally higher for higher income earners, but with proper knowledge of U.S. income tax brackets and available credits, many taxpayers can reduce their overall effective tax rate. This gives married couples filing jointly a unique advantage in managing their tax liability through tax planning.

Adjustments Due to Inflation and Tax Planning Tips

Inflation plays a significant role in shaping U.S. tax brackets, and the 2025 tax brackets for married filing jointly are no exception. Each year, the IRS adjusts the tax slabs in the USA to reflect inflation, ensuring that individuals’ purchasing power is not diminished due to higher federal taxes. This adjustment is crucial for long-term financial planning, as it helps taxpayers avoid being pushed into a higher tax bracket as a result of cost-of-living increases. For married couples filing jointly, it’s important to monitor these changes and adjust withholding or estimated payments accordingly. Effective tax planning includes using strategies such as maximizing tax deductions and taking advantage of available credits like the Child Tax Credit or EITC. Understanding these dynamics will help you reduce your taxable income and ultimately lower your federal income tax liability.

FAQs

What Percentage of My Paycheck Goes to Taxes?

The percentage of your paycheck that goes to federal taxes depends on your income tax bracket and filing status. For married couples filing jointly, your combined income determines which U.S. tax brackets apply. The 2025 tax brackets for married filing jointly include several graduated income tax rates ranging from 10% to 37%, meaning you pay different rates on different portions of your income. The effective tax rate will likely be lower than your marginal tax rate, as the first portions of your income are taxed at lower rates. For an accurate estimate, you can use an income tax calculator to determine how much of your paycheck is deducted for federal income tax based on your income brackets and any deductions or credits you qualify for.

How Much Does Federal Tax Take Out of $15,000 a Year?

If you’re earning $15,000 a year, your federal income tax liability will depend on your taxable income after deductions. For a married couple filing jointly, this amount could be significantly reduced by the standard deduction or itemized deductions. In 2025, the 2025 tax brackets for married filing jointly will start with a 10% tax rate for the lowest income range. For example, if you’re in the lowest bracket and taking the standard deduction, the federal tax taken out of your $15,000 income could be very minimal. You can calculate federal income tax precisely using an income tax calculator or by applying the tax slabs in the USA to your income and deductions to determine your specific effective tax rate.

How Do I Figure Out My Tax Bracket and Rate?

To determine your tax bracket and federal income tax rate, you’ll need to know your taxable income, which is your total income minus eligible deductions. For married couples filing jointly, you can refer to the 2025 tax brackets for married filing jointly, which detail the income slabs and the corresponding federal income tax rates ranging from 10% to 37%. If you’re unsure, using an income tax calculator can help simplify the process by providing an instant estimate based on your income and deductions. Understanding the difference between your marginal tax rate and effective tax rate is crucial, as your marginal tax rate applies only to the income that falls into that bracket, while your effective tax rate is the overall percentage of your total income that you pay in taxes.

Conclusion

In conclusion, understanding the 2025 Tax Brackets for Married Filing Jointly is essential for accurate tax planning and maximizing your savings. With the U.S. using a graduated income tax system, knowing your federal income tax rate and how it applies to your taxable income brackets can help you better estimate your yearly tax liability. Whether you’re using an income tax calculator or doing the math manually, it’s important to understand the difference between your marginal and effective tax rate, as well as how deductions and credits impact your final tax bill.

By staying informed on updates to the tax slabs in the USA, you can make smarter financial decisionsespecially if you’re planning deductions, claiming tax credits, or comparing past tax years. Filing jointly has its advantages, including higher income thresholds and a larger standard deduction, but it’s crucial to determine where you fall in the current U.S. income tax brackets.

If you found this guide helpful, please consider sharing it with friends or family who may also benefit. Have a question or want to share your experience filing jointly? Drop a comment below we’d love to hear from you!